How WOTC Filing Software Makes it Easy to Calculate Your Savings and ROI

WOTC filing can be complicated — but it doesn’t have to be when you simplify the process with industry-specific WOTC filing software from a technology partner.

For high-turnover industries like cleaning and security that traditionally build their workforce around hourly employees, it’s common to hire individuals that qualify for Work Opportunity Tax Credits (WOTC). For companies with significant annual hiring volume, using these credits can help deduct tens of thousands of dollars annually from taxable income.

How Much Can Your Company Save?

Depending on which specific targeted group an employee falls under, you could claim tax credits up to a maximum of $9,600 of qualified wages per eligible employee. To get an idea of how much estimated savings in tax credits your cleaning or security business could be claiming, try out our free ROI calculator.

Simplifying the WOTC Filing Process

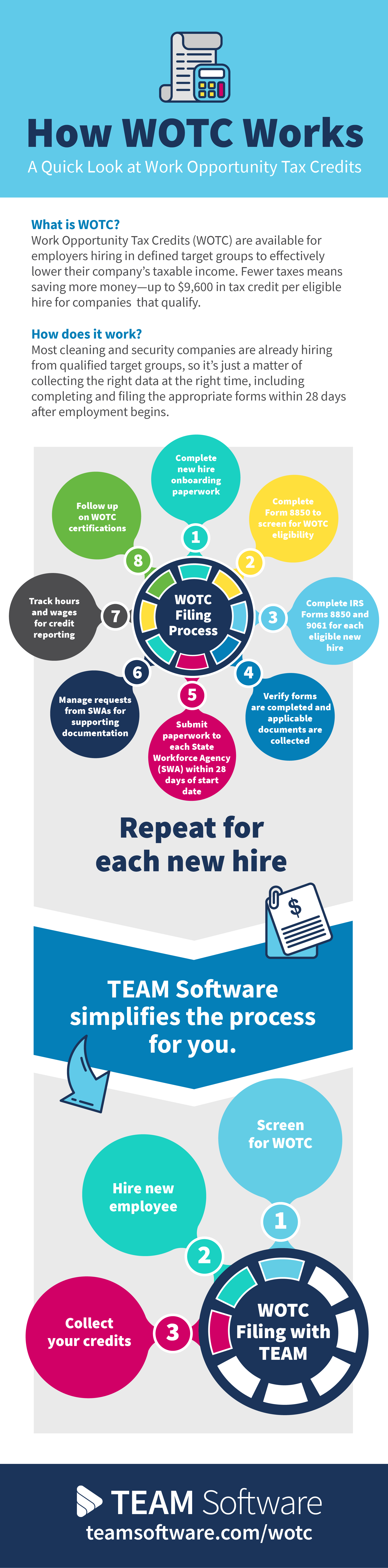

Navigating the WOTC process, especially if you’ve never filed before, can seem daunting and it’s important to verify all steps of the process are followed correctly. We’ve put together this infographic to help you understand the steps of the filing process and how partnering with a company that provides WOTC filing software and service can simplify it for you. And luckily, if you use an industry-specific ERP as your one source of record, you already have all the information you need in one place.

For a convenient quick reference guide on what is WOTC, who qualifies, how it works and how you can start saving money, download our WOTC Cheat Sheet for cleaning or security contractors.

TEAM Software is dedicated to ensuring our software solutions meet the ever-changing needs of our customers. We’re also continually working to bring you relevant content to help you manage your business better by taking advantage of programs like WOTC. While we’re committed to keeping you informed, it’s important to do your own research, and consult your own legal and tax advisors when necessary, too. For more information on the WOTC tax credit, visit the United States Department of Labor WOTC page.