A Mid-Year Labor Market Summary for the Cleaning Industry

By Claudia St. John, SPHR, SHRM-SCP, President, Affinity HR Group

Like most things these days, cleaning industry labor trends and the rebound of the labor market is complicated.

A few weeks ago, four of us went to dinner on a Sunday evening. Now Scottsdale, AZ isn’t a late-night dining town, especially on a Sunday in the summer. So, imagine our surprise when we arrived about 7:15 and found several groups waiting outside, even though there were many open tables, and the place didn’t take reservations. The explanation – not enough servers. Same situation a couple of weeks later in a huge, popular Mexican restaurant. One quarter of the restaurant was open, and two inexperienced servers worked a very busy patio.

What is going on? Aren’t people supposed to be going back to work now that many of us are vaccinated and mask, indoor dining, and social distancing restrictions have been eased or even lifted in many areas?

National Recruitment and Unemployment

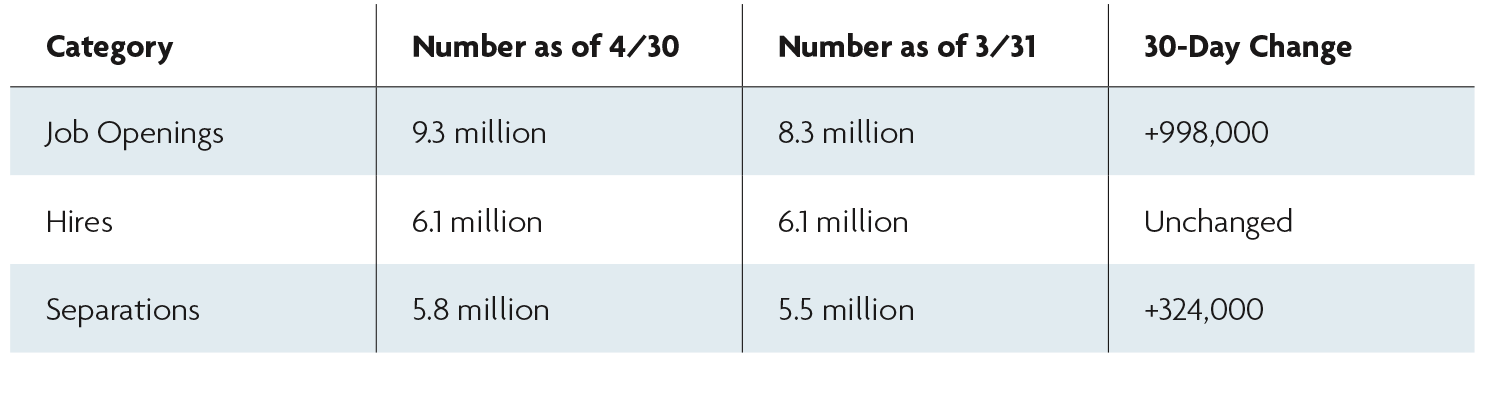

On June 8, the U.S. Department of Labor (USDOL) issued its Job Openings and Labor Turnover Survey report (JOLTS) for April. Some highlights help explain the current recruitment environment:

USDOL Openings and Labor Turnover (April 2021)

In summary, job openings and separations are on the rise but hiring is not. So many workers have left their jobs that economists are calling it the “great resignation.” It’s difficult to pinpoint a single reason for this. There are most likely several contributing factors:

- The working age population in the US is shrinking for the first time in history.

- Expanded unemployment benefits may be an incentive to stay home, although half of US states are ending this benefit prior to the original September end date.

- Retail, restaurant, and other front-line workers continue to face risk of infection.

- Child care and school reopening issues continue to keep many out of the workforce.

- Big box retailers such as Amazon, FedEx, and Walmart are recruiting tens of thousands of new workers at higher than minimum wage.

The US unemployment rate was 5.9% in June 2021, up slightly from 5.8% in May. Updated Federal Reserve forecasts predict an overall unemployment rate of 4.5% by the end of 2021 and 2021 economic growth of 7.0%.

What employers need to do:

- Anticipate continued difficulty recruiting, especially entry-level candidates

- Consider raising pay for entry-level workers to compete with big box retailers

- If raising entry-level pay, review pay levels for current, experienced employees to ensure internal equity

- Re-evaluate flexible scheduling and remote work options

- Re-evaluate experience and skill requirements for positions and provide opportunities to gain skills and credentials after hire

2021 Labor Market and Occupational Outlook for the Cleaning Industry

For janitors and building cleaners, anticipate more changes to requirements and guidelines. OSHA is expected to issue additional Emergency Temporary Standards focused on worker protections. Several government organizations, including OSHA and the National Institute of Environmental Health Services (NIEHS), offer links to training and education resources on their websites. Professional associations such as Building Service Contractors Association International (BSCAI) also offer training in cleaning and disinfecting.

The Leisure/Hospitality sector gained 343,000 new jobs in June 2021 – more than any other sector. Many jobs in this sector are entry level positions, creating additional opportunities for employees and recruiting challenges for employers.

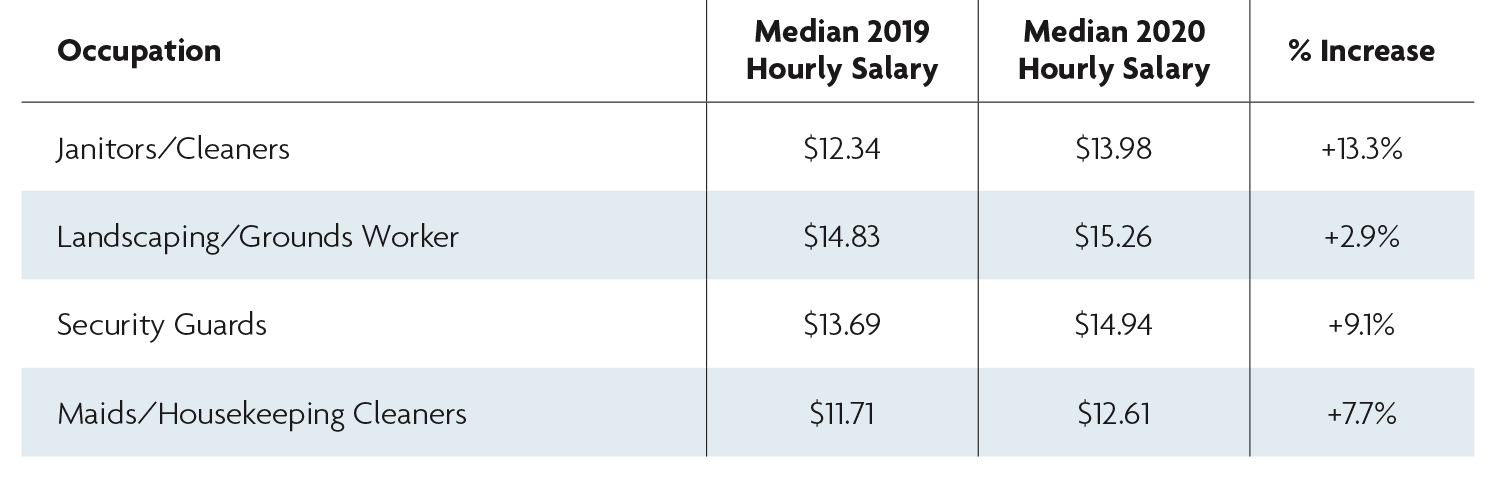

USDOL 2020 data shows significant salary gains for many of these entry level groups compared to 2019. It is likely that 2021 will result in even more significant gains.

USDOL 2020 Income Data

What employers need to do:

What employers need to do:

- Anticipate continued difficulty recruiting entry level candidates

- Understand who your competitors are for talent in your recruiting market(s) and that these competitors may be different than in the past

- Review current pay policies for competitiveness; consider raising pay to remain competitive

- Identify the best resources to help you understand and respond to regulatory changes and use those resources regularly to stay informed

TEAM Software is dedicated to ensuring our software solutions meet the ever-changing needs of our customers. While we’re committed to keeping you informed, it’s important to do your own research and consult your own legal and tax advisors with specific questions or concerns. To learn more about tax credits your cleaning or security company may qualify for, read our recent blog post on Work Opportunity Tax Credits.