Security and Cleaning Labor Market Trends Update

At the annual WorkWave conference that was held earlier this year, TEAM Software employees shared valuable insights into the labor market and hiring trends for 2023 and a forecast for 2024. Most of our labor market discussions regarding 2023 focused on the following takeaways:

- U.S. Hire and quit rates are slowly returning to pre-pandemic norms

- Hire rates in the cleaning industries were slightly below pre-pandemic norms, while security industry hires were above pre-pandemic norms in 2023

- Quit rates in the cleaning industry were below pre-pandemic norms, while security industry quits returned to pre-pandemic averages in 2023

- Rising labor participation and growth rates

- Wages are slightly above rising inflation

Labor market trends in 2023

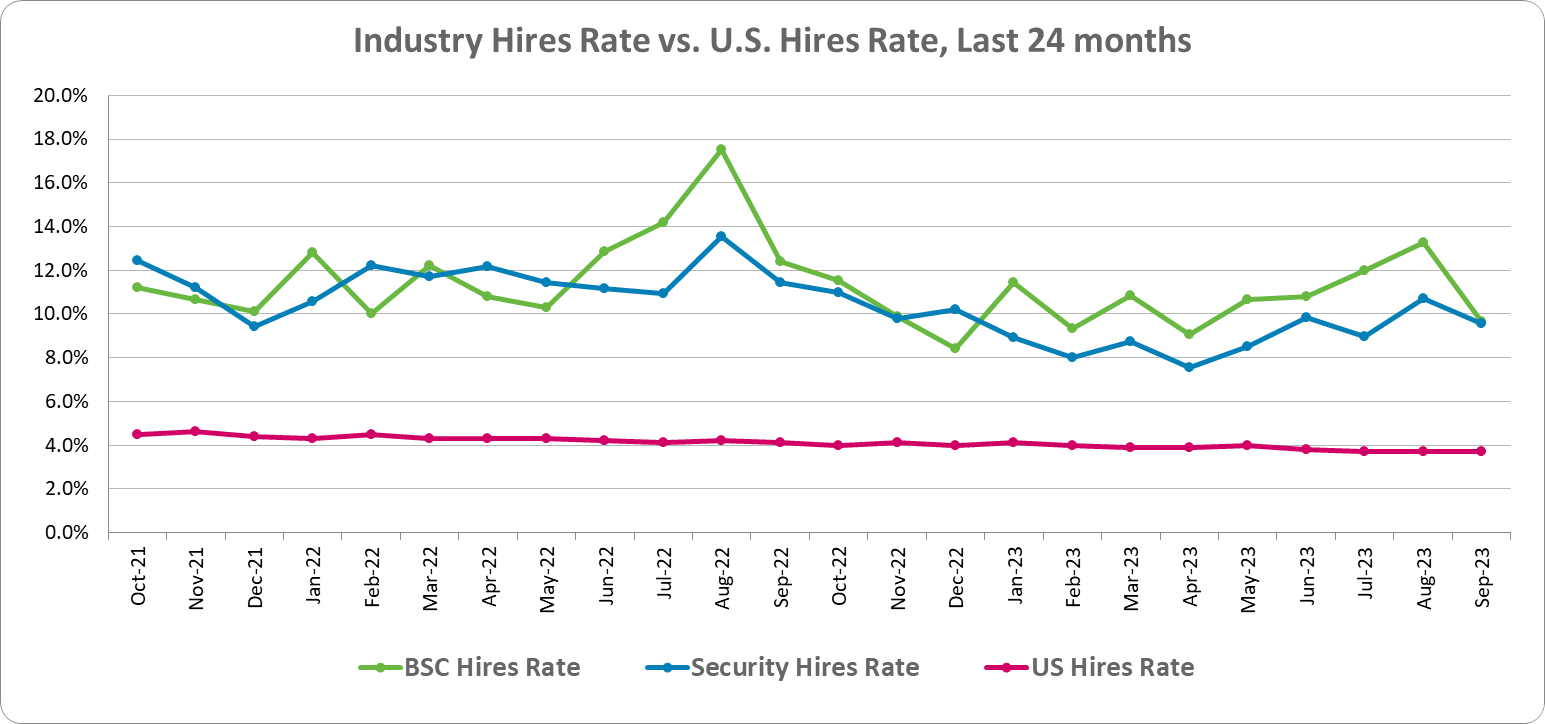

Hire rates

Hire rates are best understood as all of the additions companies make to their payroll as a percentage of total employment. In the U.S., national hiring rates throughout 2023 (industry agnostic) fell January through September, except in May. As of September 2023, the U.S. experienced a monthly 3.7% hire rate, down .4% from January, with an average hire rate of the nine months settling at 3.9%.

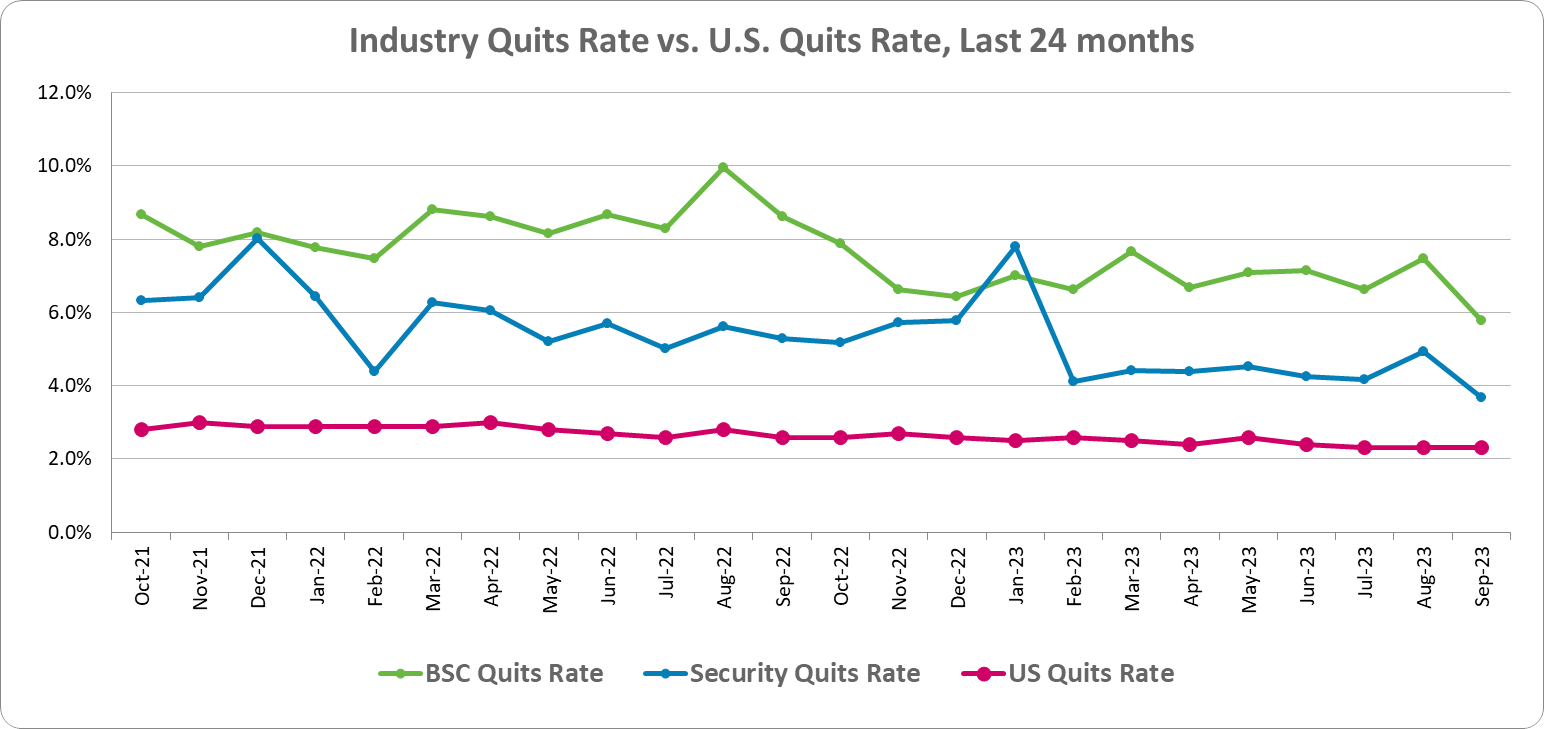

Quit rates

Quit rates refer to voluntary employee separations except retirements or transfers.

In the United States, national quit rates during the same nine-month period as above (industry agnostic) remained fairly consistent. As of September 2023, the U.S. experienced a monthly 2.3% quit rate, which fell 0.2% when compared to January, and the average quit rate settled at 2.4% over the nine months. When compared to the previous year, the average national quit rate fell from 2.8% in 2022 to 2.4% in 2023, which is about a 14.3% drop.

Industry-specific data for the cleaning and security industries

In 2022, the average hire rates for the cleaning and security industries were 11.9% and 11.34%, respectively. Similarly, average hire rates over the past seven years in each industry were 11.2% and 8.8%. Average quit rates over the previous seven years in each industry were 8.3% and 5.2%.

Between January and September 2023, the average hire rate for the cleaning industry was 10.8%, while the average hire rate for the security industry was 9.0%. Additionally, between January and September 2023, the average quit rate for the cleaning industry was 6.9%, while the average quit rate for the security industry was 4.7%.

Understanding the data

Hire rates are normalizing in both industries, while quit rates are currently lower than average in both industries.

These 2023 nine-month findings suggest that these industries are starting to return to pre-pandemic hire rates, though quit rates are still a little lower than pre-pandemic norms.

Major news sources report that the trend of workers quickly moving from job-to-job is starting to slow down. It was also reported in 2021 that businesses saw an uptick of candidates failing to arrive for job interviews and quitting after being hired. The accepted belief is that employees are still shopping for better wages and more robust benefit packages even after they get hired. This may still be taking place to some extent.

While both industries continue to have 2-3 times the quit and hire rates compared to national averages, the 2023 year-to-date values have been less volatile than 2022. It shows that quit rates are in the process of dropping back to pre-pandemic levels.

For the cleaning and security industries, these changes highlight both positive aspects and areas of concern. Overall retention is seeming to stabilize – even improve. However, we’re still seeing higher turnover within the early days of employment. For example, in 2022, over 55% of cleaning industry new hires and over 42% of security industry new hires quit within the first 60 days. Anecdotally, this has been attributed to employees chasing higher wages or unsuccessful onboarding.

Labor market trends moving forward

Overall, the current labor market remains tight and businesses all over the world are facing similar labor participation and retention challenges, amongst other obstacles. However, employers can better understand employee turnover and low labor participation to continue to attract and retain qualified talent.

While economists predict that the labor market will begin to normalize, possibly throughout 2024 but more likely in 2025, employers can acclimate by processing and reviewing as much relevant information as possible. Want to continue learning information that could help you better plan for 2024? Review our labor trends progress report.