A Look at 2020 Labor Trends for the Security Industry

How do labor trends for the security industry compare to national averages and what does it mean for your business?

In almost any industry, a business’s success can be boiled down to the people who make up its workforce, and the security industry is no different. In fact, as a security business owner, your workforce is also the biggest expense in your company’s budget, and therefore, a huge investment. Naturally, you want to do everything you can to engage and retain top talent to achieve your strategic business goals.

Over the past 15 years, the U.S. economy and job market have seen drastic ups and downs, with the most drastic occurring in the first quarter of 2020 followed by the Great Recession of 2008. With labor being a top expense, businesses with distributed workforces have felt the impact of these fluctuations stronger than others. We’ve examined how national labor trends relate to the security industry, and here are two key points for security contractors to factor into their business model.

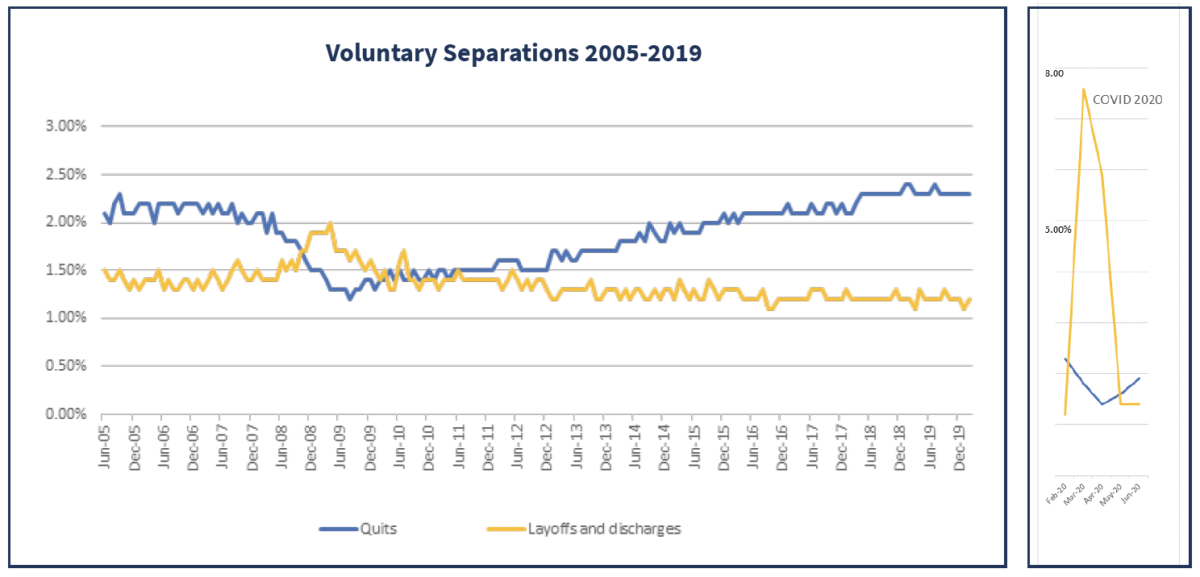

1. Quit and Involuntary Separation Rates

As of June 2020, the national quit rate was 23% lower than it was in March 2020, compared to 27% lower over the same period in the security industry. With instability and uncertainty in the market because of COVID-19, fewer people were willing to voluntarily separate from a position. However, involuntary separations, which can be attributed to layoffs or discharges, show a drastic spike nationally around March 2020, as illustrated in the graph excerpt on the right.

Conclusion: With the exception of the spike in layoffs and discharges in March 2020, quits and involuntary separation trends in the security industry have managed to remain relatively level in 2020 due to security companies taking steps to reduce and spread hours among employees rather than resorting to layoffs to conserve expenses during the pandemic.

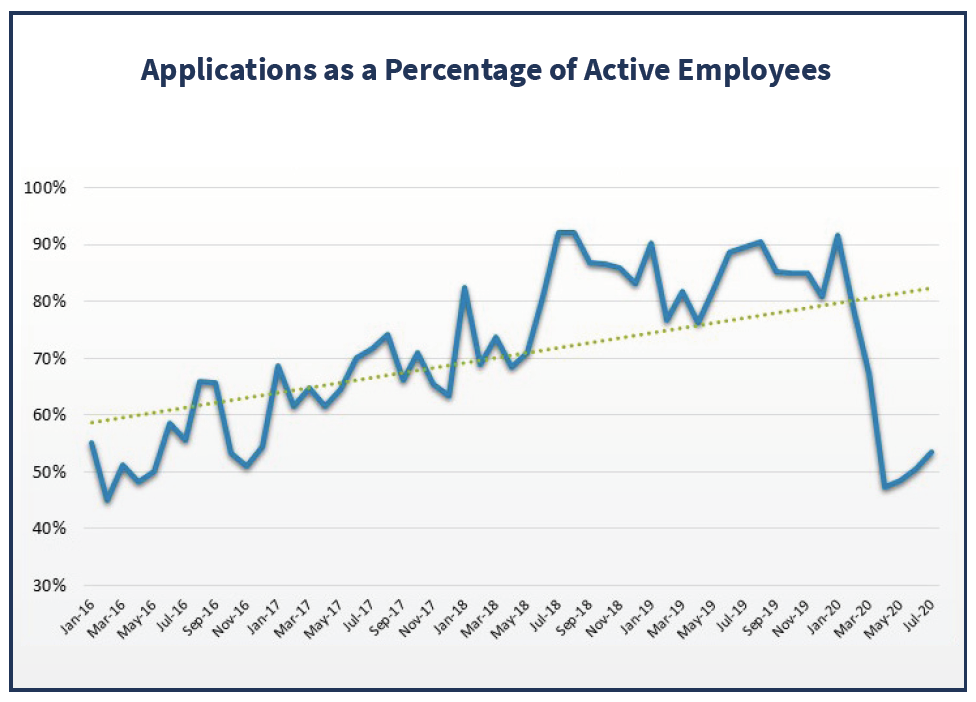

2. Applications Entering the Job Market

Prior to March 2020, the security industry had seen a consistent increase in applications entering the job market. This could be attributed to the growth in positions open, the number of job seekers looking for new opportunities and the popularity of easy-apply, one-click applications through job boards. Since March 2020, however, the security industry experienced a 50% drop in the number of new monthly applications.

Conclusion: Although jobs are available, individuals are not applying for open positions at the same rate they were before the first quarter of 2020 for no definitive reason other than a possible correlation to the pandemic.

Even though businesses may be less in danger of losing employees to voluntary separations, additional work is still likely needed to attract individuals to apply to open positions.

Understanding how your business performs in relation to the security industry and the overall labor market can help you identify areas of both strength and weakness. For additional information on labor and retention in the security industry, download our Industry Labor Trends for Security Contractors eBook.

—

The security-specific data in this article is a sample of over 20,000 employees hired through TEAM’s Kwantek applicant tracking software and processed as employees through the WinTeam ERP software between 2015 and 2020. The data was collected from seven customers who agreed to participate in this exercise.