Annual US Labor Trends Report for the Cleaning and Security Industries

US industry labor trends vs. national averages and what they mean for your commercial cleaning or security business.

2021 brought the most challenging labor market in recent times. We’re breaking down the facts on recent labor trends and what they mean for you.

What is happening to the labor market now?

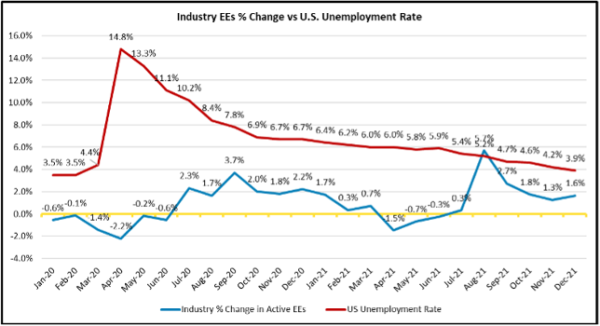

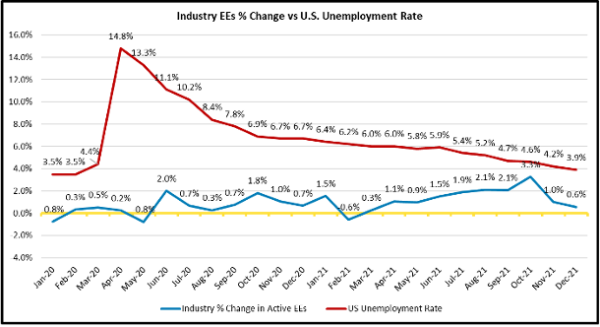

As COVID continued to influence the US economy in 2021, unemployment continued to decline from 6.4% in January to 3.9% in December. Though monthly U.S. labor participation rates have rebounded since 2020 lows, they are still averaging 1.5% less than pre-pandemic levels. Some employees simply have not returned to the workforce. Meanwhile, security and BSC employment rose an average of 1% month over month in 2021. Most notably, both industries saw higher employment growth in the second half of the year, despite the declining national unemployment figures. The workforce generational composition is also continually shifting. Employers are having to adapt to replace older, more tenured employees with younger, less experienced workers to maintain their rosters. This is particularly evident in the security industry, where Gen Z hires of 34.5% are quickly catching up to Millennial hires at 40.4%.

Percentage change in BSC employees vs. U.S. unemployment rate

Percentage change in security employees vs. U.S. unemployment rate

What it means for you: TEAM clients are finding ways to grow their teams to meet their resourcing needs regardless of the declining labor pool. Employee retention continues to be critical, but there is more pressure to increase wages and increase job attractiveness to capture and maintain employee loyalty.

Is your workforce leaving the industry?

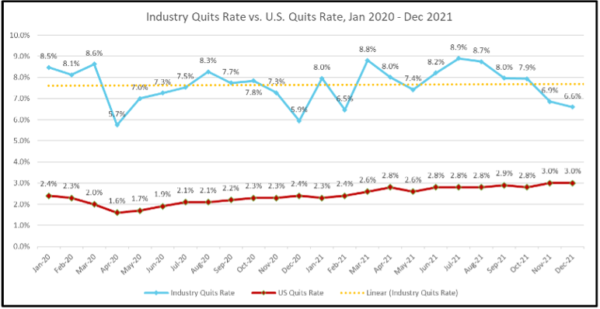

Traditionally, the security and commercial cleaning industries experience double (and sometimes more) quit rates than the broader labor market. U.S. monthly quit rates in 2021 averaged 2.7% in 2021, which is 0.5% higher than the previous 5-year average. Monthly quit rates in the cleaning industry tend to be more variable over the course of the year, but averaged 7.8%, peaking at almost 9% in July. In the security industry, average monthly quit rates were 5.5%, peaking moderately higher in October and November to 6%. Long term, the quit rates for the cleaning industry in 2021 matches the previous 5-year average. The quit rate for the security industry was 0.5% higher than the previous 5-year average. That said, while the cleaning industry isn’t experiencing abnormal quit volumes, the security industry followed the increased national trend for 2021.

BSC industry quit rates vs. U.S. quit rates

Security industry quit rates vs. U.S. quit rates

What it means for you: Employee churn is still a big challenge for the cleaning and security industries. Although quit rates aren’t abnormal when looked at on a monthly average, the differences you’re experiencing now could be due to increased competition in the market. Competitors in similar and different industries are competing for the same limited labor pool and employees of all generations are taking advantage of more diverse job opportunities and higher pay offers.

Are there applicants entering the job market?

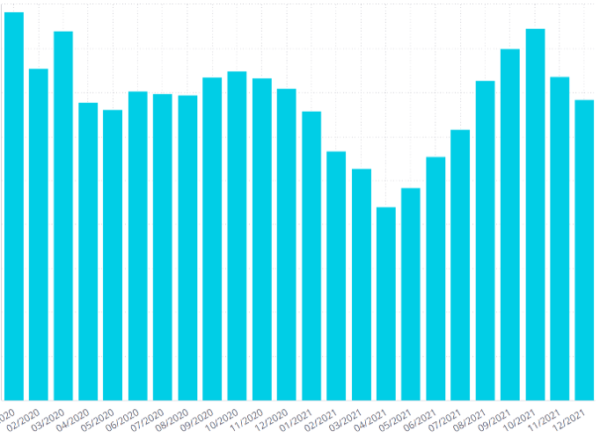

Employee counts are up, but fluctuations early in 2021 suppressed hiring activity in the first half of the year for both industries. Applicant volume in the commercial cleaning industry has more seasonal variability than security, but both have returned to pre-pandemic levels – likely due to employers adjusting their advertising strategies and investment. Given the unemployment rate trends, it’s no surprise that we continue to see fewer applicants per hire year over year.

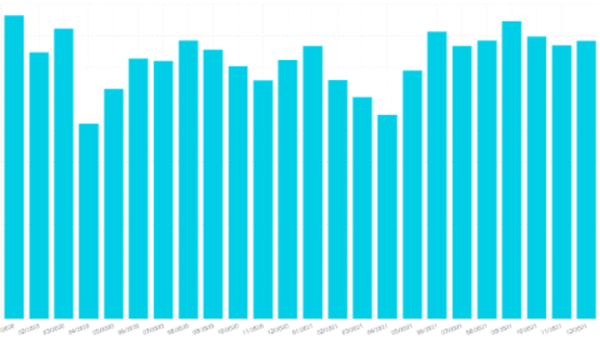

BSC applications by month

Security applications by month

What it means for you: Unsurprisingly, hire rates typically increase with more applicants. However, neither metric guarantees successful hires. One out of four hires will not last a year, and one out of ten won’t last the first week assuming they show up at all (i.e., hidden turnover). Both industries continue to struggle to get applicants to show up for their first day of work and complete their initial training.

What does this mean for your hiring efforts now?

- As inflation continues to rise, we could see reentries into the workforce out of necessity. Higher hourly rates, though, may need to rise to attract (and keep) your workforce. Contractual obligations to bill rates and overtime expenses may keep you from immediately making a change, so try to budget ahead where you can. Negotiate bill rates when you can. Even if a competitor undercuts your rate, we’re hearing of clients’ being contacted after the fact to resume work due to lack of quality in services performed.

- Know when to let your clients go. If you don’t have the resources to deliver the SLAs of a contract to specification at the rate your clients are willing to spend, you may need to walk away. Use a job costing tool to see which of your jobs are the least profitable and make your decisions around what jobs are delivering the most value to your company.

- Although participation rates are seemingly consistent, the labor market on a whole has lost 2% of the labor force. Your current employees are a prime target for potential recruitment. Market yourselves as an employer of choice for new hires and focus on retention efforts for current employees.

- Make hiring as quick and painless as you can with text-to-apply and quick apply tools. Offer incentives where you can throughout the hiring process and explore onboarding tactics pairing adjacent generational employees (Millennials to Gen Z, for example) to help onboarding succeed.

- Experiment with your hiring strategies. We’ve heard of some clients developing internship programs at the collegiate level as a recruitment tactic. Through this strategy, you can invest in your future workforce, present opportunities to potential applicants (without driving them to an online job board) and establish a relationship that will attract them as future applicants.

Read the full labor trends report for commercial cleaning companies.

Read the full labor trends report for security companies.

*BSC findings within this study are presented in partnership with BSCAI.