Integrated Payments for WinTeam Customers

What they are, how they work and why you should integrate now.

One of the main advantages of using an ERP software solution is the ability to connect – people, process and systems – to support your business profitability. Take these connections even further by tying in directly to your payment collection processes.

What are integrated payments?

Integrated payments solutions automate your financial management and accounting efforts by connecting payment portals or collection channels directly with your financial management data, like accounts receivable and your general ledger.

It helps resolve issues you may not even realize your company is experiencing. Issues like:

- Manual entry and human error

- PCI risk

- Labor-intensive reconciliation efforts

- Inaccurate financial management and accounting reports

- Tight cash flow

How does it work alongside workforce management software?

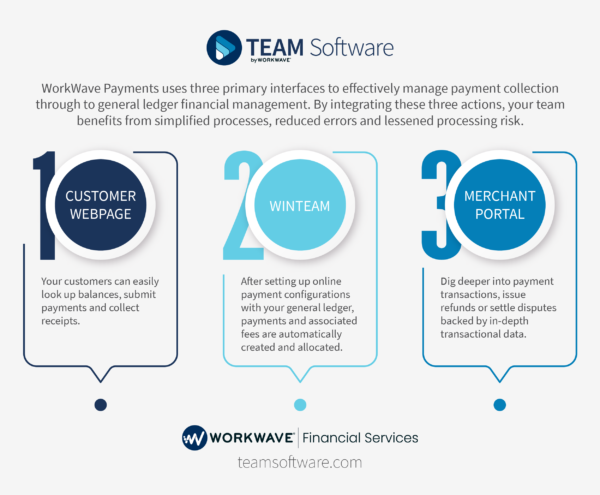

First, your customers access their customer webpage. From there, they can view balances on outstanding invoices, submit payments and collect receipts.

Once you’ve configured your general ledger to support online payments, payments and associated fees are automatically created and allocated, updating your accounting systems in real time.

Through your merchant portal, you can dig into payment transactions, issue refunds or settle disputes based on accurate transactional data.

Not a WinTeam customer? Schedule a quick call, and we’ll figure out if integrated operations, financial and workforce management software makes sense for your business case, and how WorkWave Payments give you an even stronger financial solution.

What are the benefits?

If your company currently collects some, or all, payments via credit card, there are four main benefits in connecting your collections process.

- Security. Collecting payment via credit cards can often equate to risk and liability for your company related to credit card exposure, especially since card data is often targeted information. Unified processes reduce vulnerabilities in card data security, lowering PCI risk and reducing liability.

- Reduced costs. Manual processing costs stem from activities like double data entry, manual card entering and transaction reconciliation for your administration team. Integrated systems automate data sync, providing a single source of accurate data your financial teams (and customers) can count on.

- Supports job profitability assessments. Job costing helps you determine the profitability of your individual jobs so you can better plan for the future, but the accuracy of your analysis depends on what information you’re evaluating from the start. By connecting your credit card payments with your financial management software, you can evaluate credit card processing fees at the invoice level, giving you even more visibility into individual job profitability.

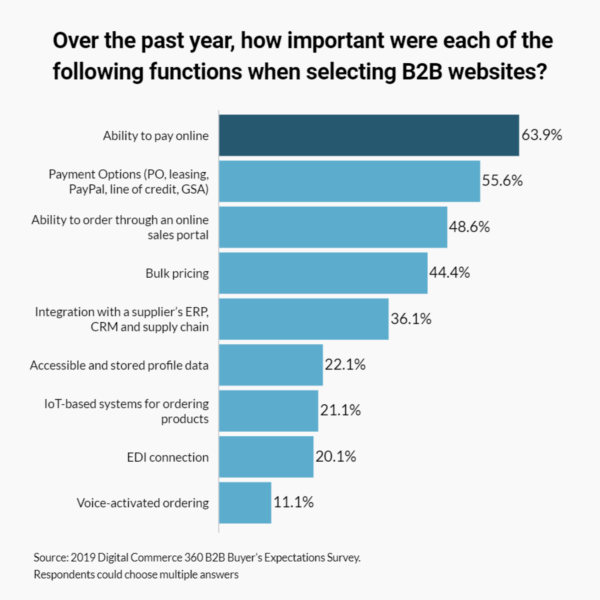

- Improves customer satisfaction. Your clients have an easy, one-stop-shop setup to look up balances, submit payments and collect receipts, a service (according to Digital Commerce 360) B2B buyers expect and need.

Survey results from Digital Commerce 360 - Shortens time to payment. By first giving your customers an easy (secure) payment gateway to fulfill their invoices, you can reduce late payments, prevent missed payments, and generally speed up fulfillment for better cash flow.

- Simplifies processes. By leaning into automations, your teams are able to redirect their resources towards the core needs of the business, rather than digging through reconciliations, collections and the creation (and allocation) of fees. As an added benefit, you don’t have to jump around to different points of contact if there is a discrepancy or question you need resolved – your support help is streamlined to a single point of contact.

Introducing WinTeam + WorkWave Payments

At TEAM Software, we’re excited to offer a solution to help you realize these benefits using WorkWave Payments. This proven, reliable and secure solution offers an end-to-end accounting and payment collections option for commercial cleaning and security companies, with no hidden fees.

Learn more about TEAM Software’s new payment integration offering, WorkWave Payments, here.