Wages vs Inflation: How Recruitment Systems Are Affected

Recent changes in inflation, combined with factors like the current labor market, present an interesting picture for weekly earnings and hourly earnings over the coming year. Wages, nominal wage growth, and inflation should all be looked at as individual components of a larger picture. From there, you can really decide what action items are needed for your cleaning or security company when it comes to budgeting for labor costs, scheduling to accommodate real wage increases, changing your recruitment systems process, and adjusting for profitability.

Inflation isn’t just a buzzword—it directly impacts the cost of living for employees and the operational costs for businesses. For American workers, the interplay between wages and inflation often determines their economic stability, while employers must navigate these challenges to remain competitive in the job market. Understanding how real wage growth compares to inflation can help your business plan effectively, especially in industries like cleaning and security where labor costs often constitute a significant portion of the budget.

These trends also highlight a broader shift in the economic environment, where corporate profits, labor shortages, and fluctuating inflation are reshaping workforce dynamics. For business owners, it’s critical to take a proactive approach to ensure that your organization is prepared to adapt to these ongoing changes. By looking at the bigger picture, you can implement strategies that not only protect your margins but also support equitable growth and improve worker power within your organization.

table of contents

What is the best definition of inflation?

It’s true, a dollar doesn’t go as far as it used to. Inflation can be measured by the general rise in the price of goods and services, which, in turn, results in a decrease in money’s purchasing power.

The U.S. Bureau of Labor Statistics defines the Consumer Price Index (CPI) as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” Frequently, CPI is used to measure inflation and track the cost of living. This metric is critical for understanding the effects of inflation on American households and businesses alike.

Do wage increases cause inflation: what’s “expected” and what isn’t?

When purchasing power decreases, it’s expected that the economy sees some kind of correlating trend with wages. According to an interview with Erica Groshen, senior economics advisor at Cornell University, wage inflation generally “lags consumer price inflation.” Assuming that’s true, that means in an economic situation of inflation, companies could theoretically be able to anticipate wage gains and plan accordingly.

Wages and real wage growth are not the same thing. Nominal wage growth refers to the raw increase in pay, but real wages account for inflation. If inflation rises at 3% and your paycheck also rises at 3%, you’ve experienced no inflation-adjusted wage increase.

Several years ago, the Federal Reserve Bank of St. Louis analyzed the relationship between wage growth and inflation. They found that during “periods of higher inflation (especially periods higher than 6 percent), the workforce has seen lower real wage growth.” For lower-wage workers, this often means earning less in real terms, which complicates recruitment and retention efforts in a tight job market.

What’s causing wage increases now?

Remember the 6 percent statistic from the Federal Reserve Bank of St. Louis mentioned above? Consider this: According to the U.S. Inflation Calculator, the U.S. economy began 2021 with inflation at 1.4% and ended at 7%. For American workers, this means that while nominal wage growth may appear promising, real wage increases are lagging due to the effects of inflation.

A Willis Towers Watson survey shows the average U.S. employer is expecting to raise wages by 3.4% this year. While that’s higher than in recent years, it’s still insufficient to match inflation, further exacerbating challenges for low-wage workers.

Wages, inflation, and real wage growth in the cleaning and security industries.

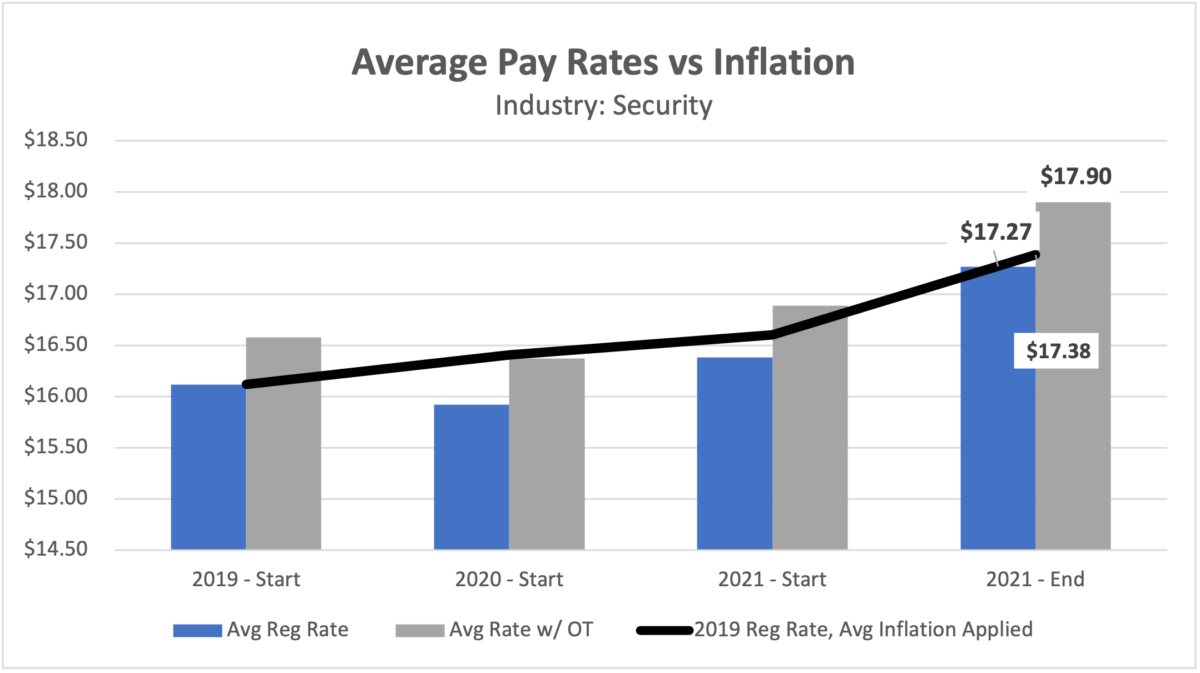

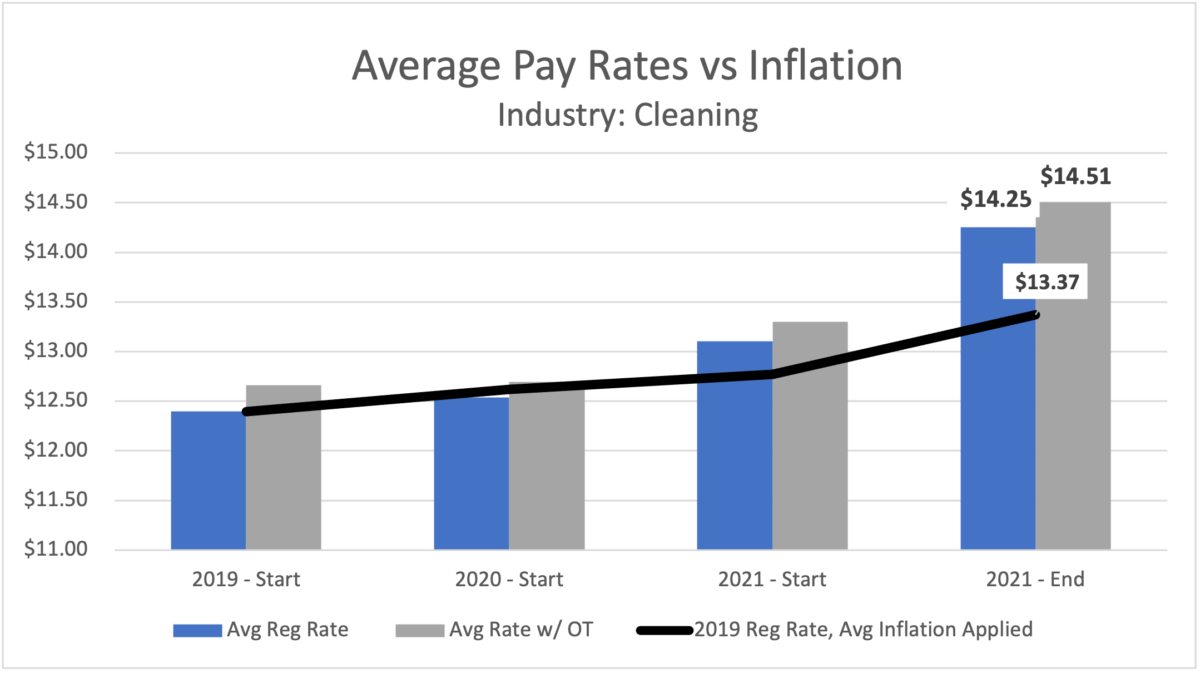

Our findings show that annual wage growth in the security and cleaning industries is outpacing inflation. Security companies are paying hourly employees an average of $17.27 (a 0.64% increase over inflation) while cleaning companies are paying $14.25 (a 6.58% increase over inflation). Factoring in overtime, these percentages are even higher.

This demonstrates that corporate profits in these industries are being reinvested in inequitable growth for employees. With competitors like Amazon increasing hourly wages to $18, cleaning and security businesses are finding innovative ways to attract and retain talent, even amidst labor shortages.

Average Hourly Wage Pay Rates Vs Inflation – Cleaning Industry

Average Hourly Wage Pay Rates Vs Inflation – Cleaning Industry

This demonstrates that employers in the cleaning and security industries are valuing wages significantly enough to compete against rival companies (and rival industries) for talent. Especially considering Amazon, arguably one of the highest competitors drawing talent from other industries, raised average hourly wages in the U.S. to $18 per hour — that’s not too far off from what the security industry is benchmarking today.

What can we expect in the future?

At this point, we’re relying heavily on economists to provide clarity. Federal Reserve Chair Jerome H. Powell has projected inflation to decrease to 2.6% next year, meeting the Fed’s inflation target. However, many American households will continue to face challenges as cost-of-living pressures persist.

Globally, inflation is also expected to decrease gradually. While this offers hope for improved economic growth, businesses must remain vigilant in adjusting strategies to ensure continued gains for workers.

What’s next for you

Have Conversations

Even if inflation drops over the next year, price levels are unlikely to return to pre-pandemic levels. Start conversations with suppliers and clients to renegotiate contracts and find cost-effective solutions. By proactively addressing the economic environment, you can protect margins and ensure sustainable growth.

Adjust for Inflation

Determine whether wage gains are feasible for your company. Highlight average wages and other perks in job listings to attract applicants in a competitive job market. Benefits like early wage access and flexible scheduling can also boost worker power and retention.

Schedule Smart

Not all employees are paid the same, so factor in measures of earnings when scheduling shifts. Smart scheduling ensures profitability while avoiding unnecessary wage creep.

*Findings are derived from aggregate data of U.S. TEAM customers in the building services and security sectors.

Partnering with TEAM Software

Partnering with TEAM Software by WorkWave can significantly benefit your security or cleaning business. This software helps address challenges like recession fears, labor shortages, and wage pressures. Key features include:

1. Efficient Employee Management: Schedule shifts, track performance, and improve weekly earnings.

2. Real-Time Communication: The software allows for real-time communication between you and your team, enabling quick responses to client requests or changes in scheduling.

3. Automated Invoicing and Billing: Fully automates the invoicing and billing process, making it easy to keep track of payments and ensure timely billing for your clients.

4. Reporting and Analytics: Leverage insights to drive equitable growth and enhance recruitment systems.

Conclusion

In today’s competitive landscape, understanding the delicate balance between wage growth and inflation is crucial for businesses, particularly in sectors like building services and security. As we have explored, the interplay between wages and inflation can significantly impact recruitment systems and overall operational efficiency. When wages do not keep pace with inflation, employee satisfaction and retention can suffer, resulting in increased operational costs and challenges in maintaining a well-staffed workforce.

Understanding the balance between wage growth and inflation is essential for cleaning and security businesses. TEAM Software provides the tools you need to navigate these challenges, foster worker power, and achieve operational excellence.

By leveraging the capabilities of TEAM Software, businesses can not only navigate contemporary wage and inflation challenges but thrive amid them. This partnership presents a proactive approach to managing human resources more effectively while fostering an environment that prioritizes employee satisfaction and operational excellence. Ready to grow your business? Book a free demo today!