Wage Growth vs. Inflation (and Recruitment Systems)

Inflation, wage growth and what it means for cleaning and security companies (and your recruitment systems).

Recent changes with inflation, combined with factors like the current labor market, is presenting an interesting picture for wages over the coming year. Wages, real wage growth and inflation should all be looked at as individual components of a larger picture. From there, you can really decide what action items are needed for your cleaning or security company when it comes to budgeting for labor costs, scheduling to accommodate wage changes, changing your recruitment systems process and adjusting for profitability.

What is the best definition of inflation?

It’s true, a dollar doesn’t go as far as it used to. Inflation can be measured by the general rise in the price of goods and services (which, in turn results in a general decrease of money’s purchasing power).

The Bureau of Labor Statistics defines the Consumer Price Index (CPI) as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” Frequently, CPI is used to measure inflation.

Do wage increases cause inflation: what’s “expected” and what isn’t.

When purchasing power decreases, it’s expected that the economy sees some kind of correlating trend with wages, as well. According to an interview with Erica Groshen, senior economics advisor at the Cornell University School of Industrial and Labor Relations, wage inflation generally “lags consumer price inflation.” Assuming that’s true, that means in an economic situation of inflation, companies could theoretically be able to anticipate a correlating increase in wages.

Wages and real wage growth are not the same thing. Real wage growth is defined as the difference between wage growth and inflation. If inflation rises at 3% and your paycheck also rises at 3%, you’ve experienced no real wage growth, even if the dollar amount on your paycheck has technically gone up.

Several years ago, the Federal Reserve Bank of St. Louis looked at the relationship between wage growth and inflation. Their findings showed that during “periods of higher inflation (especially periods higher than 6 percent) the workforce has seen lower real wage growth.” Effectively, that means when wages don’t increase at the same rate as inflation, employees are making less money. In a tough labor market, like what most industries are currently experiencing, this can further complicate employee hiring and retention.

What’s causing wage increases now?

Remember the 6 percent statistic from the Federal Reserve Bank of St. Louis we mentioned above? Consider this. According to the U.S. Inflation Calculator, the U.S. economy began 2021 with inflation at 1.4% and ended at 7%. If you assume the findings from the bank hold true, that means we’re actively in a period where wage growth is unfavorable to the employee.

That theory is supported by other findings. According to a Willis Towers Watson survey, the average U.S. employer is only expecting to raise wages by 3.4% this year. Even though that’s larger wage growth than recent years, it’s well below the rate of inflation we saw at year-end.

That’s not the case for the cleaning and security industries.

Wages, inflation, and real wage growth in the cleaning and security industries.

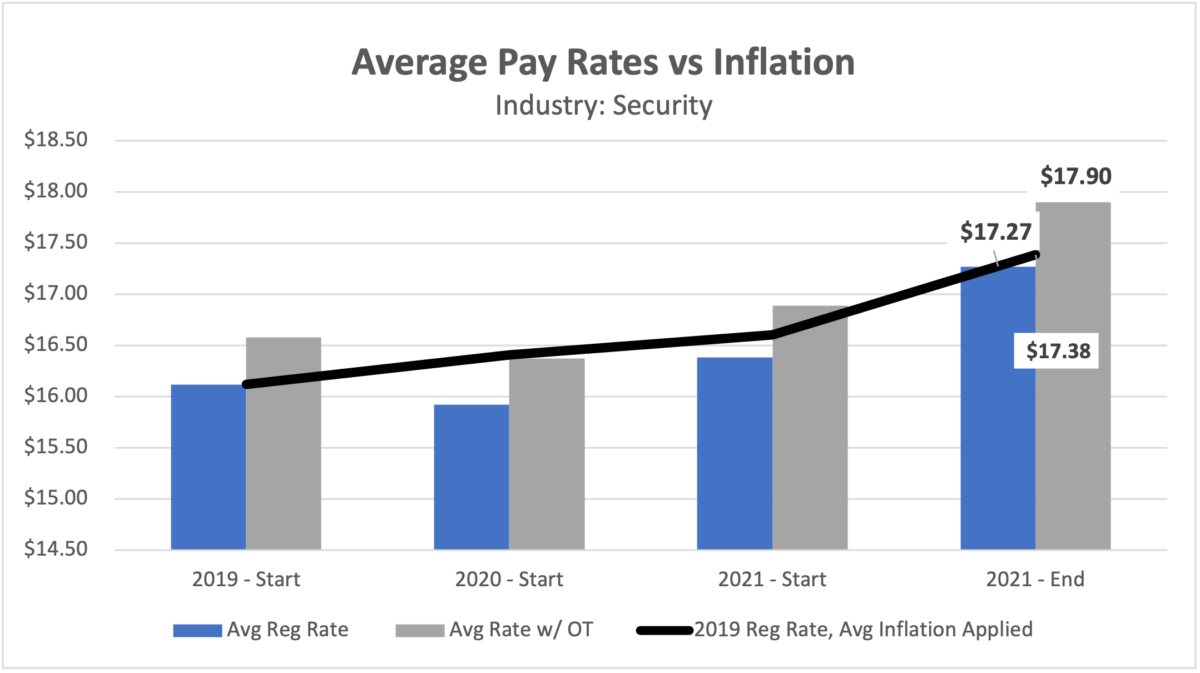

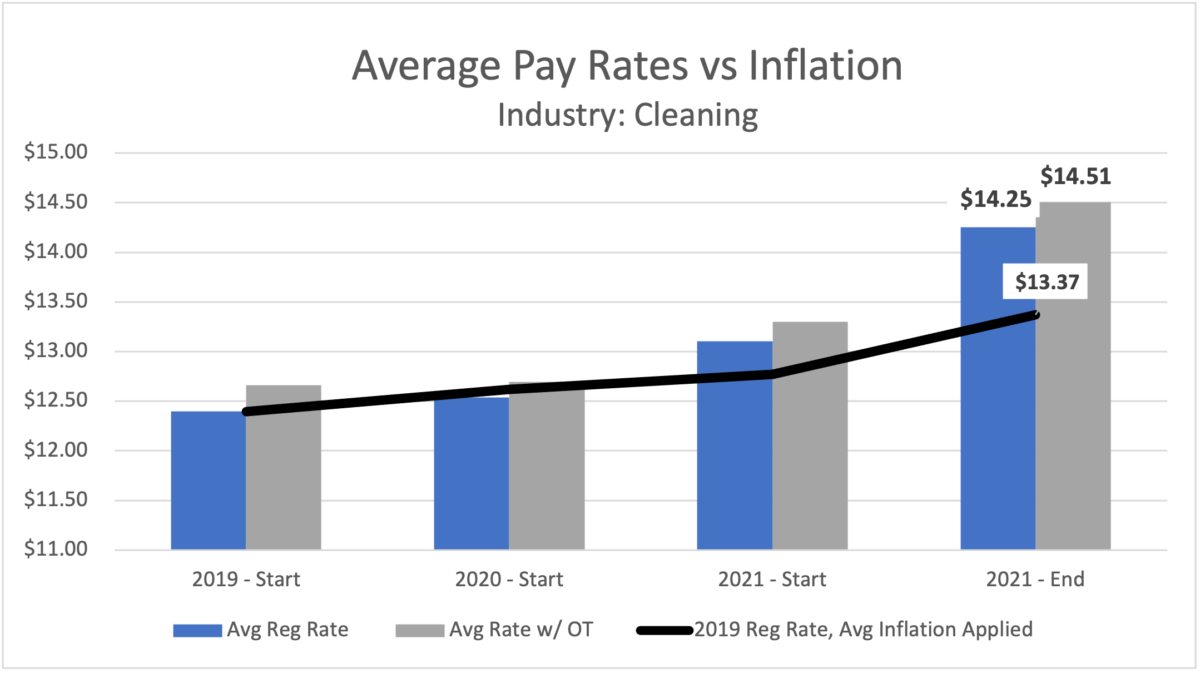

Our findings* show wage growth in the security and cleaning industries is tracking above the rate of inflation as of year-end, with security companies paying hourly employees an average of $17.27 (a 0.64% increase over the rate of inflation) and cleaning companies paying $14.25 (a 6.58% increase over the rate of inflation). When factoring in overtime, those percentage increases are even more sizable.

Average Hourly Wage Pay Rates Vs Inflation – Cleaning Industry

Average Hourly Wage Pay Rates Vs Inflation – Cleaning Industry

Average Hourly Wage Pay Rates Vs Inflation – Cleaning Industry

This demonstrates that employers in the cleaning and security industries are valuing wages significantly enough to compete against rival companies (and rival industries) for talent. Especially considering Amazon, arguably one of the highest competitors drawing talent from other industries, raised average hourly wages in the U.S. to $18 per hour — that’s not too far off from what the security industry is benchmarking today.

What can we expect in the future?

At this point, we’re relying heavily on economists to say for sure. Federal Reserve Chair Jerome H. Powell is projecting inflation to decrease (to the tune of 2.6%) next year. The catch? Those projections aren’t anticipated until the end of 2022.

Outside of the U.S., inflation is expected to gradually decrease as well. Which means, you’ve still got a long haul over the course the next year to address wages and inflation within your business.

What’s next for you

- Have conversations. Even if inflation drops over the next year, that doesn’t mean prices levels will go back down. It’s time to start thinking about saving where you can. In some ways, that can start with a conversation, both with your suppliers and your clients.Work with your preferred distributors and ask for supply alternatives that may be less expensive. Have an open conversation with your clients (especially on unprofitable contracts) and renegotiate scope or SLAs, billable work, or a mixture of both.*Are you not sure you’re getting the best picture on job profitability? Learn how we can help you job cost at the job level.

- Adjust for inflation. Determine if there is room for wage growth within your company. If nothing else, our findings provide a benchmark for what’s a current average standard in your industries at the time of publishing. If you can afford to be on-par with benchmarks, you may be able to attract interested applicants.

- This is probably the biggest mindset change your business should consider. With wages outpacing inflation in the cleaning and security industries, it’s possible your company just can’t afford to increase wages further. If you’re offering above the inflation rate, market that, and build that into your recruitment system and processes. Include wages as a benefit in job listings and hiring conversations.Don’t stop there. Market the other benefits that help you stand out apart from wages. Things like early wage access, flexible hours and scheduling and benefits could be just as beneficial to a potential job candidate as an incremental increase in pay.We’ve even had customers quoted saying that more frequent pay (which early wage access can provide) is a true retention tool for employees who may be tempted by competitor wages.

- Schedule smart. Not all of your workforce is hired at the same rate, and they shouldn’t be scheduled in the same way, either. Don’t forget to factor in pay scales when scheduling employees for shifts (and overtime) and monitor wage creep.

*Findings are derived from aggregate data of U.S. TEAM customers in the building services and security sectors.