Combatting the Labour Market with Earned Wage Access

The global labour market is tough. Labour participation is low – even as the cleaning and security industries improve hiring rates, the total number of active workers at any one time isn’t increasing.

The problem? Employee turnover.

According to TEAM Software by WorkWave’s data, security companies must hire 108 applicants a year just to maintain an average annual headcount of 100 employees. In the cleaning industry, that estimate is as high as 133 applicant hires.

These statistics underline the importance of strong retention programs, but even those come at a challenge. Some tried and true methods of retention – like incentivised referral programs, wage increases or bonuses – may be harder to budget for as companies try to protect cash reserves in case of a recession.

There are other options. Earned wage access integrations can provide service contractors with a low-risk solution for increasing employee benefits without impacting cash flow.

Defining earned wage access

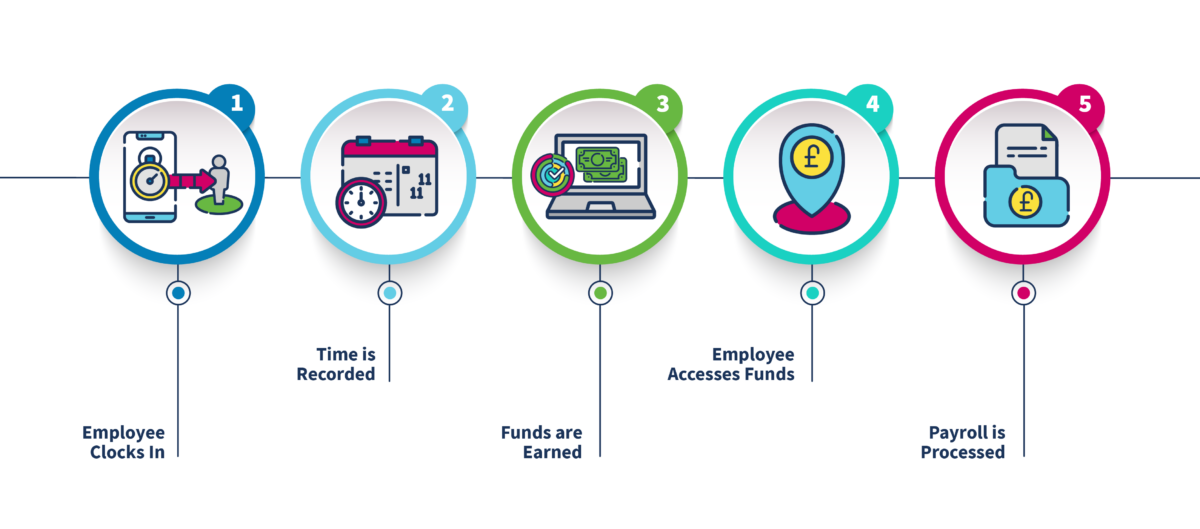

Earned wage access provides a way for employees to receive payment for hours worked, without having to wait for the next pay cycle to process.

How is earned wage access beneficial to employees?

In service industries, one of the biggest barriers employees face in succeeding at a field job is the reliability of their transportation. Sometimes, the gap between paychecks impacts a worker’s ability to afford transit, let alone living expenses.

How is it beneficial for employers?

An on-demand approach to earned funds can make a big difference in employee financial wellness even during times of economic stability.

In recent years, markets around the globe have experienced rising fuel prices, energy crises and spikes of inflation. Around the world, it’s estimated anywhere from a third to two-thirds of employees live paycheck to paycheck.

These challenges can be even more pressing to individuals working in service industries.

For example, access to transportation can be a challenge for field-based workers who need to travel to one or more job locations to complete their shift. Public transit and personal vehicles depend on fuel to work. When there are steep hikes in gas prices, for example, the decrease in affordability makes it harder for field-based workers to report to their assigned location. Without a reliable workforce, contracts are more likely to go unfilled and create gaps in service delivery (and customer satisfaction.)

By providing a view into their earned wages with the ability to withdraw from the balance early, it benefits employees and employers by encouraging good electronic timekeeping habits and improving retention rates.

How does it work with existing payroll processes?

An earned wage access integration simply connects your workforce management solution (which houses functions like scheduling, time and attendance and payroll) with an on-demand payment platform.

Because the platform acts as an early-access account, the integration does not impact or complicate your current payroll processes.

“Adding the integration into your payroll flow is a seamless process for your payroll teams since an enrolled employee is simply getting their direct deposit funds automatically rerouted,” said Stephanie Petersen, Associate Product Manager, TEAM Software by WorkWave.

A use case for paying employees faster with earned wage integrations

Even when labour trends demonstrate more unemployed persons per job opening, the physical security industry consistently records turnover rates anywhere between 100-400%.

In more recent times, where the number of unemployed persons per job vacancy has been at or less than one, companies like GardaWorld are experiencing heightened challenges in attracting and retaining talent from competitors in and outside of the cleaning and security industries.

“We began to see trends in competitors beyond the security industry who were paying their employees more frequently,” said Matthew Wilson, GardaWorld. “With the labour pool continuing to tighten, we knew we needed to look at ways of giving our own employees faster access to their wages.” The goal was easier said than accomplished. The task force considered altering payroll to a weekly cadence, but the change would have been more time-consuming and disruptive to current payroll and scheduling processes while negatively impacting cash flow.

Six months after implementing TEAM Software by WorkWave’s earned wage access integration, GardaWorld saw a 54% adoption rate from their workforce, with expectations of even more use when the service is rolled out to their event service population. To date, over 31 million dollars worth of earned wages have been taken in advance.

“For GardaWorld, initiatives like this really center around improving the welfare of our employees,” said Wilson. “The integration gives us a way to provide a real benefit to our employees – employees whose needs may outpace a regular payroll cycle.”

The amount of earned wages taken before payroll processing averages $110 per employee.

“Early access to earned wages helps give us the means to support our employees when they have a need, and as a result, helps ensure they’re able to get to their shift. We’re then able to keep our contracts fully covered and our clients satisfied. From every angle, it’s a win.”

Improve benefits fast

While common benefits improvements – like raising wages – become harder to cash flow, benefits like earned wage access can be fast, easy and low-risk for service companies to implement.

As more industries try offerings like this to both retain more talent and attract applicants, many hiring managers may soon find it as a “need-to-have” in order to stay competitive.

Find out more about earned wage access by contacting TEAM Software by WorkWave today.